Are you looking for a way to be more philanthropic this year and make the most of your charitable donations? When the federal standard deduction doubled in 2018, many found they no longer qualified for itemization. Since then, many donors have found that utilizing a “bunching” strategy with a Donor Advised Fund (DAF) allows them to continue to support the causes they care about and still get the tax benefits of their charitable giving.

If your itemized deductions are less than $13,850 for single filers and married filing separately or $27,700 if married filing jointly, you don’t meet the minimum requirements to itemize your federal tax deductions. There is substantial tax savings potential if you can exceed the itemization threshold. Charitable bunching works by bunching together an amount equal to two or three years of your normal charitable donations and contributing it to a DAF. By “bunching” your giving, you will exceed the standard deduction threshold in the year of the donation, and you can continue to give to your usual charities by making grants out of your DAF.

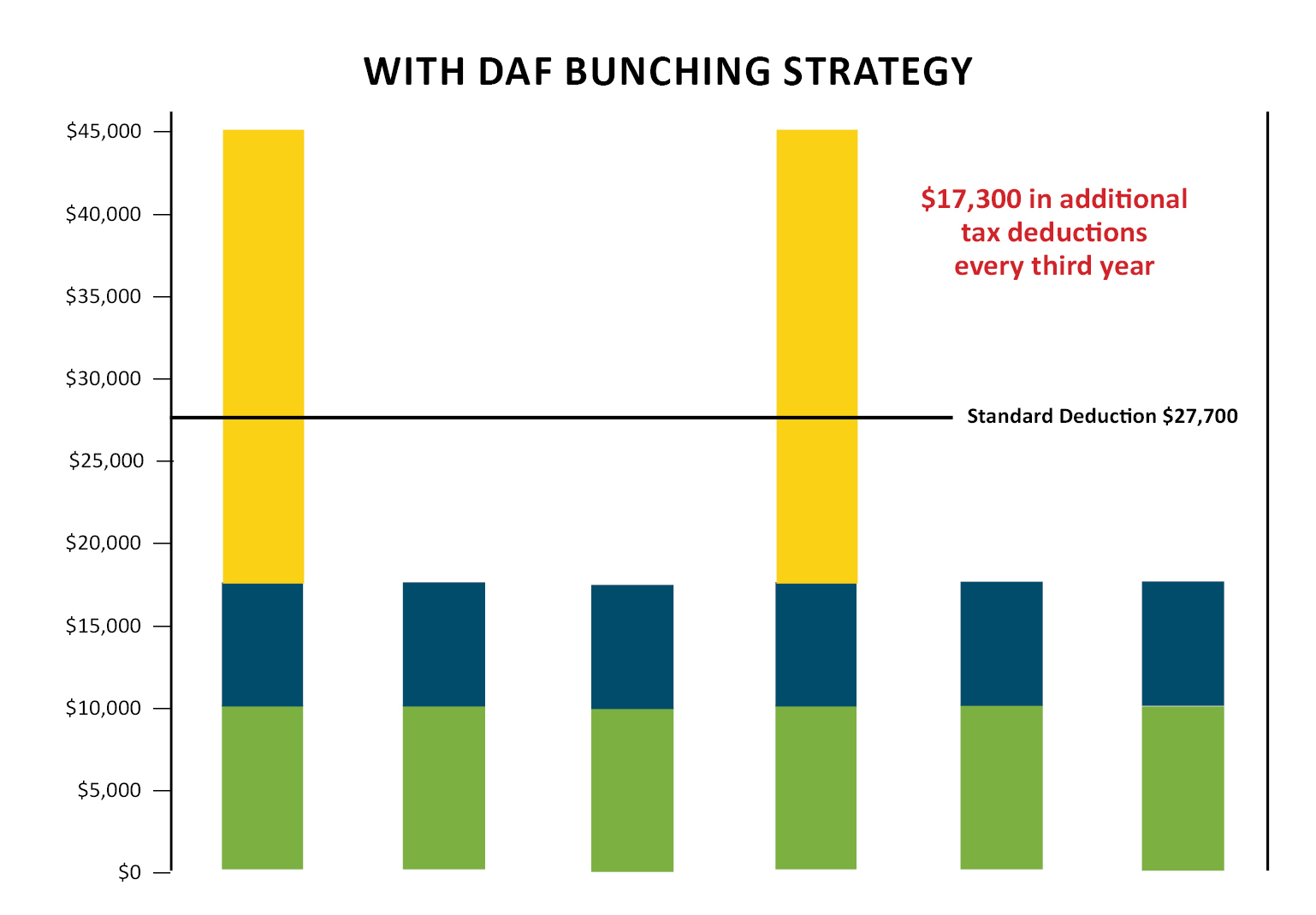

Here is an example of how this might work. Fred and Wilma Flintstone donate around $9,000 annually to various charities around Bedrock. But even with their state and property tax and mortgage interest deductions, they are still below the $27,700 needed to qualify for a standard deduction. They consult with their professional advisor and decide to bunch three years of their usual giving into one year; in this case, that would be $27,000. They donate the $27,000 to their Donor Advised Fund at the local Community Foundation. Because a DAF is designated for charitable use only, donations made to it are entirely tax-deductible. With the addition of state and property tax and mortgage interest deductions, this tax-wise strategy allows the Flintstones to surpass the standard deduction threshold. They could realize additional deductions of more than $17,000, and the tax savings can be used to increase their support of their favorite causes.

Charitable bunching is a way for people to be more philanthropic. Although you won’t bunch your giving every year, you can support your favorite organizations and causes even in “off” years through grants from your DAF. With just a few clicks in the online portal or a call to the office, your grants will be on their way. Because you set aside your charitable funds in advance when things get tough, there is a natural disaster, the market drops, or some other unforeseen circumstance occurs, your funds are at the ready. Plus, the assets you don’t distribute continue to be invested, so your giving can grow tax-free.