As the landscape of philanthropy continues to evolve, more and more people are looking for innovative and tax-efficient ways to support their favorite charitable causes. Giving through Individual Retirement Accounts (IRAs) is an increasingly popular option with several key benefits.

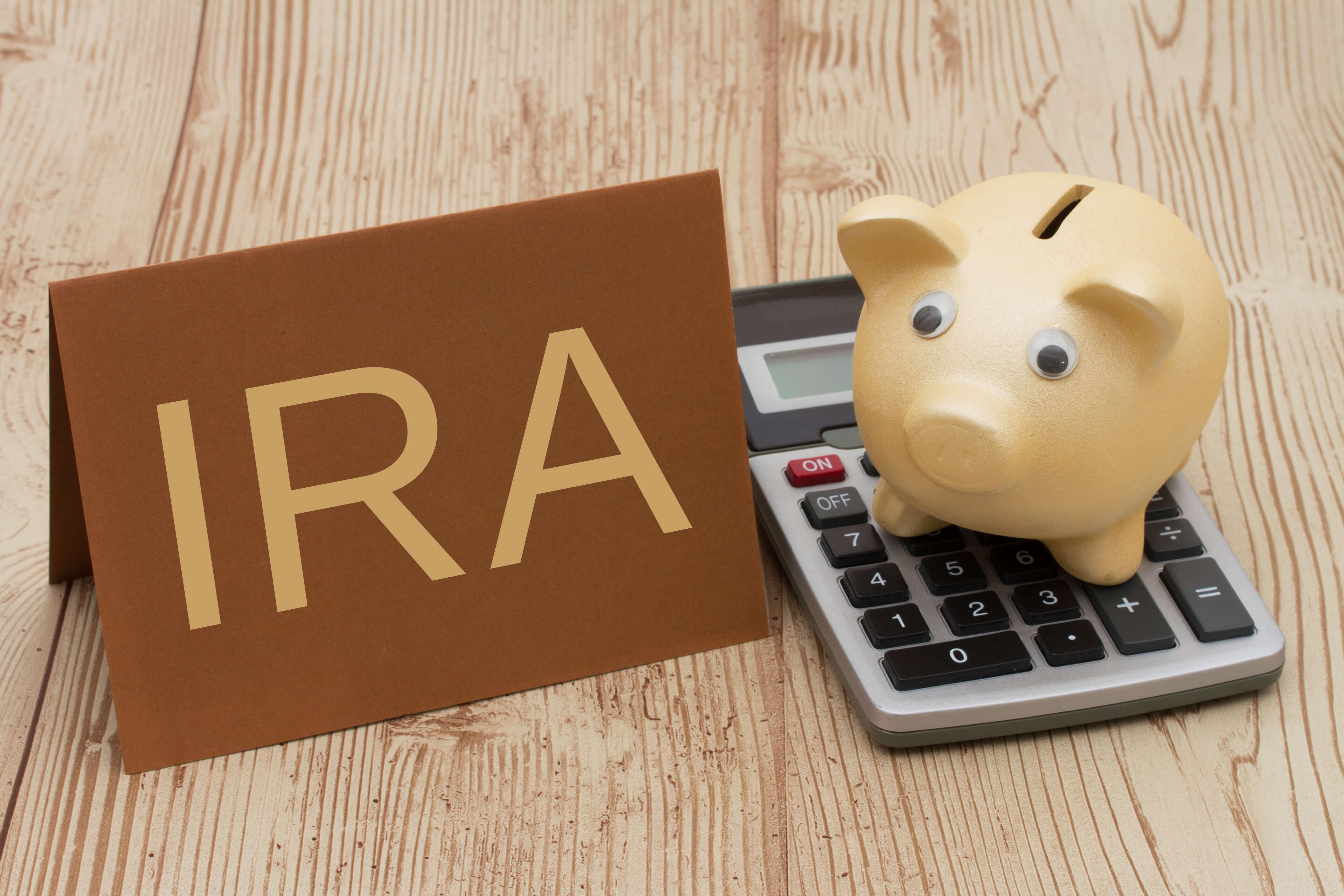

Tax Advantages. Donating directly from your IRA to a qualified charitable organization can provide significant tax benefits. Individuals aged 70½ or older can make tax-free transfers of up to $105,000 per year from their IRAs to qualified charities. This can satisfy required minimum distributions (RMDs) while reducing taxable income, providing a valuable tax-saving opportunity.

Impact Giving. When you use your IRA for charitable donations, you can make a significant impact on the causes you care about. While rules prevent the use of QCDs to establish a donor advised fund, you can use QCDs to set up a scholarship fund or field of interest fund or contribute to the competitive grant process at your community foundation.

Simplified Process. Making charitable gifts through your IRA can streamline the donation process. Direct transfers from your IRA to a charity or community foundation are excluded from federal income tax, making giving more efficient and hassle-free.

Estate Planning Benefits. By designating charitable organizations or your fund as beneficiaries of your IRA, you can contribute to worthy causes while reducing the impact of income and estate taxes on your heirs. This approach can offer estate planning advantages and create a lasting philanthropic legacy that could last for generations.

Giving through your IRA is just one way to maximize your charitable impact while benefiting from valuable tax advantages. As always, it's important to consult with a professional financial or tax advisor to explore the implications and benefits of making charitable contributions through your IRA. You can also reach out to Cole Eason, Vice President of Advancement at the foundation, at 816.912.4182 for assistance. By leveraging this strategic philanthropic approach, individuals can combine their charitable intentions with thoughtful financial planning to make a meaningful difference in their communities and beyond.