As summer is winding down, many of us are looking ahead for ways to give back and make a difference in our communities. Charitable bunching is a financial strategy that can help you maximize the impact of your donations while also providing you with some tax benefits.

So, what is charitable bunching? It's a simple concept that involves combining several years' worth of charitable donations into a single year. By doing this, you can exceed the standard deduction threshold and itemize your deductions, which can result in significant tax savings.

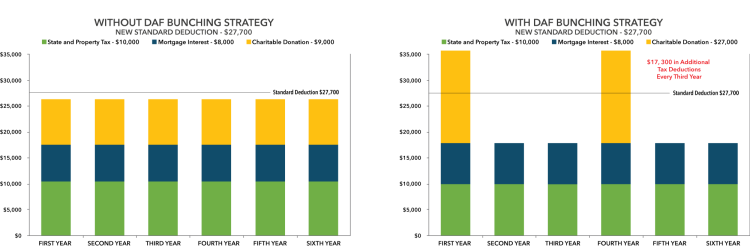

For example, let's say you typically donate $9,000 to charity each year. Under the current tax laws, you would likely take the standard deduction of $13,850 for a single filer or $27,700 for a married couple filing jointly. However, if you were to bunch your donations over three years and give $27,000 to charity in a single year, you would exceed the standard deduction threshold and be able to itemize your deductions. This could potentially save you more than $17,000 of dollars in taxes every third year.

But the benefits of charitable bunching go beyond just tax savings. By utilizing your DAF to manage your charitable giving, you can simplify both your donation process and the amount of paperwork you have to organize at tax time. Plus, because you have flexibility in the timing of your gifts, you may be able to manage a larger gift that can be used to support a specific project, campaign, or initiative.

Your Financial Advisor or your friends at the Foundation can explain how charitable bunching allows you to be more intentional with your giving. We take the time to research and confirm that the organizations you want to donate to align with your values, are valid 501(c)3 nonprofit organizations, and are actively working to make a significant impact in your community. We can help you do more good, with a lot less effort.

Overall, charitable bunching is a smart strategy for anyone looking to donate to charity on a regular basis. By combining several years' worth of donations into a single year, you can have a greater impact on the organizations you support and save money on your taxes. So, as you plan your charitable giving with your financial advisor, consider the benefits of a DAF bunching strategy and learn how it may help you make a more significant impact in your community.