It happens every year about this time. You check your mailbox, and there they are, among the Valpak coupons, grocery ads, and various bills … tax documents. Tax season is coming. Are you ready?

Changes in tax laws have made it more challenging to claim donations to qualified charities through itemized deductions on your tax return. But there are still ways to make charitable gifts work for the causes you believe in while also saving on taxes.

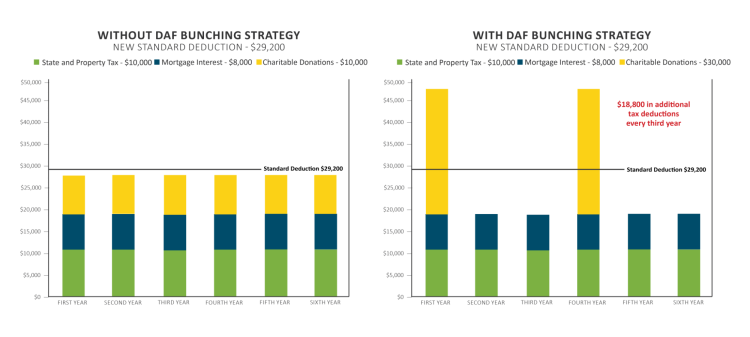

It has become much more challenging to itemize your taxes with the standard tax deduction for individuals, currently at $14,600 and $29,200 for married couples. If you fall short of the standard deduction, you can utilize your charitable giving to give you the boost you need to qualify by using a charitable bunching strategy.

A charitable bunching strategy involves utilizing a Donor Advised Fund to group or “bunch“ your contributions that you would make over several years in one tax year. For instance, you could group all your charitable donations together every third year and contribute to (or establish) a donor advised fund with an amount equal to the total needed for three years of giving. In the year you contribute to your donor advised fund, you can itemize your deductions when filing your tax return and receive a sizable deduction. In the following two years, you can continue to support your favorite charities by making donations in the form of grants from your donor advised fund and claim the standard deduction on your tax returns. This method allows you to maximize the tax benefit of your charitable contributions.

Additionally, with a donor advised fund, your donations are invested and grow tax-free, ultimately giving you the ability to donate more to charity over time. And if, instead of using cash, you utilize appreciated stock to make a donation into your donor advised fund, you can also avoid paying the capital gains tax on the appreciated stock.

So, while tax laws may have made it harder to claim donations to qualified charities on your taxes when itemizing, a bunching strategy can help you exceed the standard deduction amount and maximize the tax benefits of your charitable contributions. At Truman Heartland Community Foundation, we are committed to helping you achieve your charitable goals while making the process of giving simple and stress-free. Reach out to our VP of Advancement, Cole Eason, at 816-912-4182 or eason@thcf.org, or talk to your financial advisor to explore how a bunching strategy can work for you.